What is Dental Savings Plan?

A dental savings plan (such as DentalPlans.com) is like a discount program, which people can buy into as an affordable alternative to traditional insurance. Dental discount plans can make services and procedures more budget-friendly for you and your family. Plans typically average between $120 for individuals and $169 for families annually.

Although it’s not the same thing as insurance, it has a set fee schedule at which different types of dental procedures are discounted. Usually, it’s a 15-50% savings on various dental procedures.

The biggest difference in dental savings plans and traditional insurance is that the savings plan option doesn’t have an annual spending limit. If you want to schedule three cleanings a year instead of two, you can; if you need over $1,500 of dental treatment, you can schedule it all within the same year without worrying about your discounts running out – you can’t do that with insurance.

Plus, there are generally no waiting periods like there are with dental insurance plans.

What is Dental Insurance?

Dental insurance is a type of health insurance that pays for dental care. You pay monthly premiums for the dental insurance plan, and in return, the insurance pays a portion of your dental costs. Typically, you’ll have a copay for office visits and specific services for in-network providers that have been negotiated between the dental insurance company and the providers.

Many dental insurance plans will cover 100% of two preventative care visits a year, including routine cleanings, exams, X-rays, topical fluoride, and sealants. Dental insurance can also lower the cost of procedures like fillings, extractions, crowns, and root canals.

With some plans, you can pay as little as $15 a month after your monthly premium. However, there is an annual maximum that dental insurance plans will pay for coverage — usually between $750 and $1,500.

Most dental insurance plans have a deductible you must meet before the policy covers a portion or all of the costs, as well as yearly caps for the amount the dental insurance pays out. You may have a waiting period of up to 12 months before the dental insurance plan covers some procedures. It is important to thoroughly read through the dental insurance plan’s terms to understand what is covered and what isn’t.

There are three types of dental insurance plans, each with their own unique rules and benefits:

Dental Health Maintenance Organization (DHMO)

Dental Preferred Provider Organization (DPPO)

Dental Indemnity Insurance

DHMOs | DHMOs have the lowest premiums of all dental insurance plans, rarely have an annual maximum, and have no limit on annual dental services. However, DHMO plans limit which dentists you can see and still receive coverage. |

DPPOs | DPPOs pay the most for services you receive from dentists on your plan’s list. However, these plans pay less for the services you receive from dentists outside your plan’s list. DPPOs also have higher premiums and deductibles than DHMOs and have an annual maximum for coverage. When the annual maximum is reached, you pay the remaining cost of dental services at a discounted rate determined by the plan. |

Dental Indemnity Insurance | Dental Indemnity Insurance Plans allow you to see any dentist and receive full coverage. But these plans also have the highest premiums of any dental insurance plan and require deductibles and co-payments like DPPOs. After insurance pays the claim, you pay for the balance up to the dentist’s usual fee. If your employer doesn’t offer dental coverage, you can purchase your own plan from a state health insurance marketplace, or on a private exchange. |

1. Cigna

2. Humana

3. Delta Dental

5. UnitedHealthOne Dental Insurance

In addition, you can check the price and terms of local dental insurance plans on eHealthInsurance.com.

Dental Savings Plan vs. Dental Insurance

Below is a dental plans comparison of dental savings plans (also known as discount dental plans) vs. dental insurance:

| Dental Insurance | Dental Discount Plan | |

Preventive care | 100% two preventive care visits/year, including routine cleanings, exams, X-rays, topical fluoride and sealants. | Discounted preventive care visits (usually only 10%1); it’s rare for the plan to cover half the cost. |

Dental procedures | Can lower the cost of fillings, extractions, crowns and root canals. | Discounted dental procedures (usually only 10%1); it’s rare for the plan to cover half the cost. |

| Dental providers | Your insurance’s network of providers. | Access to a single dental provider. |

Cost | Some plans for as little as $15/month after your monthly premium. | Averages around $120 a year for an individual, $169 a year for a family. |

| Waiting period | Varies, depending on the provider. | Typically no waiting period. |

Annual maximums | Dental insurance plans have an annual maximum that they will pay for coverage. | Dental discount plans do not pay for coverage, so you do not have an annual maximum. |

Vision | You can bundle your dental insurance with a vision plan to save money. | You cannot bundle dental discount plans with a vision plan. |

Pros & Cons of Dental Savings Plan

Here is a collection of the advantages and disadvantages of the Dental Savings Plan, you can learn more about it.

Pros

Makes dental care less expensive

Can fill gaps for those without dental insurance

No waiting period to use for treatment

No deductibles or copays

No caps on number of dental visits per year

Dental savings plans typically cost less than dental insurance plans. You can save up to 60 percent of the cost for many dental procedures, and there are no deductibles or waiting periods. You current dentist probably works with a variety of savings plans, so call the office to learn which plans your dentist accepts. There are no health restrictions that prevent you from qualifying for a dental savings plan.

Cons

Doesn’t cover 100% of the cost of any service

Limits on whom you can seek care from

The most significant drawback to a dental savings plan is that you pay out-of-pocket for all of your dental procedures, although at a discounted price. That means you must be able to afford the discounted rate at the time of service to be able to get the dental work you need to be completed. Although you get a discounted rate, this can make it difficult to get the services you need.

If you plan to go to many dentists or specialists, it may make sense to choose a dental insurance plan that helps to absorb some of the costs.

Pros & Cons of Dental Insurance

Below is the advantages and disadvantages of the Dental Insurance.

Pros

The most significant advantage of having dental insurance is the savings it can provide. While the cost of cleanings and checkups may be minimal ($127 on average), the expense of having more intensive procedures completed can increase quickly. In the case of pricey non-routine dental care like a root canal, dentures or implants, the high cost can be mitigated by dental insurance, so you don’t have a massive effect on your finances.

Another benefit to having dental insurance is that it raises the likelihood that you will see a dentist at regular intervals. Many people avoid going to the dentist until they have a problem due to the cost of treatment. With dental insurance, the cost of preventative visits is usually covered, and if you have good dental health, going to the dentist may not cost you anything.

Cons

One of the most significant obstacles with using a dental insurance plan is the time it takes to see a dentist. Many insurance plans only cover a certain number of visits per year, and those visits have to be a certain length of time apart. It could be months before you see a dentist again so that your insurance can cover it.

Like many health insurance plans, dental insurance premiums can be expensive under certain circumstances. Anyone with poor dental health may pay a higher premium because more dental work is expected throughout the year the plan is active. Where you buy dental insurance is also a factor for premium costs. Group plans like those employers offer to employees have better rates than individual dental insurance policies. Many retirees elect to work part-time to participate in group medical and dental insurance offered by larger employers and save on rates.

High deductibles can also be a problem with dental insurance. Based on the specifics of the plan that you choose, you may have to pay a high deductible before services are covered. If you need emergency dental work or complex procedures, you will pay for a significant portion of it before your insurance begins to cover any of the cost.

Who Should Consider a Dental Savings Plan?

Dental savings plans may be a better fit for some people than others. If you're wondering whether you should try a dental savings plan, here are some scenarios in which one might make sense:

Your dental care needs are minimal: If you have good oral hygiene and don't need care beyond check-ups and cleanings, then you could save money with a discount plan option.

You have extensive dental work: A dental discount plan could also work for you if you have dental insurance but it doesn't fully cover all of your care needs. Having both dental insurance and a dental savings plan could help you save money when it comes to paying out-of-pocket expenses for dental care.

You need dental care while you're between jobs: If you become unemployed and lose your dental insurance, then a discount plan could help fill the gap until you're eligible to enroll in your new employer's insurance plan.

You're on Medicare: Medicare covers medical care but not most dental care. If you're on Medicare and need preventive care, basic, or major dental services, a dental discount plan could help keep your costs to a minimum.

Can You Combine a Dental Discount Plan with Dental Insurance?

It’s up to your dentist whether you can combine dental insurance with their dental discount plan. Some dentists will let you use their dental discount plan to reduce your out-of-pocket dental care costs once you’ve reached the annual maximum on your dental insurance plan.

If your dentist allows you to combine a dental insurance plan and a discount plan, and your dentist is within the network of your dental insurance, you may be able to submit a claim to your insurance to receive a discount from the dental plan for the remaining out-of-pocket insurance plan balance.

However, some dentists will not allow you to use your dental insurance and your dental savings plan for the same procedure.

In sum, unless your dentist is in both networks and willing to accept both forms of payment, you may not benefit from having both an insurance and dental discount plan.

Dental Savings Plan vs. Dental Insurance: Verdict

If you have healthy teeth and don't expect any serious trouble, a basic dental insurance policy will likely suffice, because the small savings you might see from a good discount plan probably isn't worth the extra time it will take you to shop for one. On the other hand, if you know you're going to be spending some time in the dentist's chair soon, and especially if you require an expensive dental procedure immediately, the right discount dental plan could save you hundreds of dollars a year. (Here's how to avoid buying scam insurance.)

We also found the cheapest dental discount plans aren't of much value, meaning you need to compare specific procedure discounts in order to find the plan that best suits your needs.

Be prepared to do some research to uncover a plan's exclusions and limitations before you buy, or you might be surprised by unexpected expenses later.

Best Dental Discount Plans

1. DentalPlans.com (www.dentalplans.com)

DentalPlans.com is a leading online marketplace for dental savings plans, an affordable alternative to traditional dental insurance. In business since 1999, DentalPlans.com is dedicated to ensuring every uninsured or underinsured individual and family in the U.S. has access to affordable dental care so they can receive the care they need, and deserve, to lead happier, healthier lives.

They offer cost effective dental savings plans from more than 30 of America’s most trusted brands including Aetna, Careington, and Cigna, accepted by more than 140,000 participating dentists across the country.

And, plan members benefit from their industry-leading customer service. Their : DP AtYourService Team is available to assist customers with choosing the perfect plan for their needs and budget, finding a quality dentist in their area, and leaving no question – big or small – unanswered.

With DentalPlans.com, you can save 10-60% on most dental procedures, at 140,000+ dentists nationwide. No caps, limits or waiting to get the care that you need.

Go DentalPlans.com to order dental discount plans, and don't forget to sign up at Extrabux (What is Extrabux?) , then you can get 20% super cashback from Extrabux! Sign-Up Bonus: Free to join it & get $20 welcome bonus!

Promotions

1. Labor Day Sale: 15% off all dental savings plans (sale ends 9/6 ).

2. Careington1.com (www.careington1.com)

Careington is the brainchild of two dentists. Over 40 years ago they realized that many people were not receiving proper dental care, due in large part to financial reasons.

Their expertise has given Careington first-hand experience when it comes to understanding the care and needs of dental patients, now helping millions of Americans nationwide.

The doctors founded a nationwide member network that helped both companies and individuals. They amassed a fraternity of dentists who agreed to charge considerably lower fees to their counterpart patient members… and it worked!!

This expertise has given Careington first-hand experience when it comes to understanding the care and needs of dental patients. Because of this industry knowledge, Careington members are offered a dental plan package that is both comprehensive and current with the latest procedures.

With over 15 million satisfied members and growing, Careington has positioned itself to be the innovative dental partner in the country! With Careington, you can save 20%-60% on most dental procedures.

Extrabux is an international cashback shopping site, offering up to 30% cashback from 10,000+ Stores!

iHerb, Walgreens, Gousto, Orgain, Puritan's Pride, Pharmaca, Texas Superfood, Lloyds Pharmacy, Rite Aid, Dr. Schulze's, Vitacost, Myprotein AU, Vitabiotics, etc.

Join to get $20 welcome bonus now! (How does Welcome Bonus work?)

Recommendation

-

Is Turkish Airlines Good for International Flights?

-

10 Best & Stylish Winter Coats for Women on NET-A-PORTER in 2025

-

Top & Best 12 Sneaker Apps/Websites for Raffles, Releases & Restocks in 2025

-

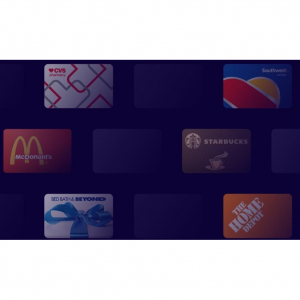

7 Best Gift Card Exchange Sites - Buy, Sell and Trade Discount Gift Card Safely and Instanly!

-

Top 9 Professional Skincare Brands for Licensed Estheticians 2025