Compare 7 Money Transfer Apps: Western Union vs. MoneyGram vs. Remitly vs. Xoom vs. Wise vs. Others

Money transfer apps, also called peer-to-peer (P2P) apps, let you transfer cash from one person to another quickly and securely. They simplify payments and also allow you to use a digital wallet to link your credit card or bank account. You can make electronic transactions and payments with just a few taps on a mobile device. If you're looking for the best money transfer apps, there are a lot to choose from these days. Such as Western Union, MoneyGram, Remitly, Xoom, Wise, Venmo, and WorldRemit. But which one is the best? We compared fees, speed, and other features to find the best providers for domestic and international money transfers.

1. Remitly (www.remitly.com)

Remitly is an international payments company that leverages digital channels, including mobile phones, to send money internationally. Remitly lets you send money fast from the U.S. to over 90 countries, especially the Americas. Competitors that have options for delivery within minutes tend to have higher fees, but Remitly balances speed with decent prices. It often charges fixed fees around $4 for sending money, depending on the country, amount sent and payment method.

Remitly’s exchange rates generally have a rate markup from below 1% to just below 3% that largely depends on the currency and payment method, but they're roughly on par with similar competitors.

Best for:

People who want cheaper or fee-free options for sending money fast and an easy mobile app experience.

Pros & Cons

What We Like

1. Fast delivery options. | Remitly has the ability to deliver money to recipients within minutes if you use a debit card. |

2. Two plans to send money – Express and Economy. | The Remitly Economy option allows you to send money for fees as low as $3.99 or send over $1,000 for $0 to some countries. |

3. Promotional rates. | First-time users of Remitly will get a significantly cheaper promotional rate for a limited amount of money, depending on the receiving country. (Expiration dates on these promotions can be changed by Remitly at any time.) |

4. Robust customer service. | Phone service is available 24/7 in English and Spanish, and live chat is also available 24/7 in English, Spanish and French. Remitly’s FAQ section of its website has a clear list of common questions sorted by category and is available in 11 languages. |

5. Strong mobile experience. | Remitly's mobile apps offer a resoundingly positive experience, earning a 4.9-star rating for iOS users and 4.8 stars for Android users, both on a 5-star scale. |

6. Offers a variety of pay-in and pay-out options. | Options to receive money (Bank transfers, pick up points, home delivery, and mobile wallet transfers); Funds your transfers with a credit card, debit card, or bank transfer (depending on the plan). |

What We Don't Like

Low sending limits. | At $2,999 to $10,000 (depending on how much information you provide to confirm your identity), sending limits are much lower than some competitors’, some of which don’t put a cap on how much you can send. |

Credit card fees. | Funding transfers with a credit card costs an extra 3% of the transaction amount, which is similar to what some competitors charge and less than others. |

Long delivery times for Economy option. | Cheaper transfers, using your bank account, take three to five business days for delivery. |

| A limited number of origin countries, and they can't send to each other. | Doesn’t allow transfers between the 16 sender (major) countries (focused on sending money home to family and friends). |

Transfer Fees

Remitly money transfer fees are based on several different factors:

How much money you are transferring;

Where you are transferring money to;

How you are funding your money transfer;

The currency the beneficiary is receiving the transfer in;

The transfer service you choose.

They generally charge a flat fee (like $2.99 or $3.99) for a transfer.

Notices:

1. If you’re opting for Express transactions, you can fund your transfer with your credit card. But this will cost you an extra 3% of the transfer amount.

2. Bank fees: If you’re funding your transfer from your bank account and sending money to a bank account, the banks at either end can charge a small fee.

3. Exchange rate margin: To calculate the Margin Fee, open Remitly, then open XE to get the interbank rate. Take the Remitly number and minus it from the XE rate. You will get a number like 0.04. Multiply this number by the amount to get the margin fees you will pay in the margin.

Click here to get more details.

Exchange Rates

Remitly’s exchange rates are competitive and are typically between 0.5% and 2% worse than mid-market rates. Create an account with Remitly and log in to see the exchange rates you will be charged, depending on where you are sending to. For example, take a look at the mid-market exchange rates for various currencies compared to the exchange rates offered by Remitly.

Sending US Dollars from the US to Honduran Lempira

Mid-Market Exchange Rate: 1 USD to 24.75 HDL

Remitly Exchange Rate: 1 USD to 24.64 HDL

Remitly's rate is 0.5% worse than the interbank rate

If you’re transferring 1,000 USD, this would mean you pay $5 more, plus Remitly’s fee of $10.99 to $15.99.

Sending British Pounds from the UK to Bolivian Boliviano

Mid-Market Exchange Rate: 1 GBP to 8.92 BOB

Remitly Exchange Rate: 1 GBP to 8.71 BOB

Remitly's rate is 2.4% worse than the interbank rate

If you’re transferring 1,000 GBP, this would mean you pay £24 more, plus Remitly’s fee of £0.99 to £14.99.

Transfer Time

Remitly may offer two delivery speeds – sometimes called Economy or Express. We recommend using Express when you need to send money fast, delivery is usually within minutes when using a debit card, and Economy when you’re able to wait 3-5 business days for your funds to be delivered.

Ways to Send Money with Remitly

1. Bank Deposit

Send money directly to a bank account.

Cash Pickup

Get cash from thousands of locations in minutes.

Mobile Money

Send money instantly to a mobile money account.

Home Delivery

Have your money delivered to your recipient's home.

Payment Options

Your payment options vary according to your location. Use the list below to see what payment types work with Remitly. For more information about sending money, check out the transfer guide for your country.

Visa and Mastercard (debit or credit cards) — all sending countries

Prepaid cards — all sending countries

Bank account — U.S., Canada, and Australia

Maestro cards — European Union and U.K.

Klarna (also called Sofort) — Austria and Germany

Bank transfers (also called Faster Payments) — U.K.

iDEAL — Netherlands

Passbook — U.S.

Manual transfers (sometimes called SEPA credit transfers) — France

Customer Service

Remitly offers both phone and email support. But a few users complained that customer service team members responded with generic messages to their concerns.

As an online-only service, Remitly keeps costs low with a remote customer service team. However given the challenge of keep costs low and still looking after you, they do quite well.

Promotions

1. First-time users of Remitly will get a significantly cheaper promotional rate for a limited amount of money, depending on the receiving country.

2. Refer friends and earn money for your next send.

3. Complete your transfer on Remitly.com, and don't forget to sign up at Extrabux (What is Extrabux?) , then you can get up to $10 super cashback from Extrabux! Sign-Up Bonus: Free to join it & get $20 welcome bonus!

2. WorldRemit (www.worldremit.com)

Launched in 2010 by Ismail Ahmed, WorldRemit is a money transfer service that allows you to seamlessly send money overseas via its online platform. The company was formed with the view of reducing the highly expensive fees charged by legacy transfer service firms like Western Union.

Based in London, World Remit also has office locations in the U.S., Poland and the Philippines. Its international network of banking providers spans over 150 countries, subsequently allowing people to send and receive money with ease.

Since the company was formed in 2010, WorldRemit has serviced over 4 million customers, across more than 90 individual currencies.

However, it is important to note that on top of bank-to-bank transfers, World Remit also offers cash pick-ups and mobile-to-mobile payments in certain countries. This is ideal for those that need to send money to friends or family based overseas that don’t have access to everyday banking services.

As an organization that operates in the UK, World Remit is authorised and regulated by the Financial Conduct Authority (FCA). This ensures that World Remit has your best interests at heart, and that you have a stringent regulatory oversight keeping tabs on the company at all times.

Pros & Cons

What We Like

Straightforward website. | Signing up and sending money can be done in as little as a few minutes and support can be accessed through phone, email, live chat and FAQs. |

Worldwide network. | Customers in more than 50 countries can send funds to over 150 countries using a variety of methods, including bank transfers, cash pickup at thousands of locations, door-to-door delivery, delivery to services like Alipay and more. |

Flexible payment options. | Pay with a credit or debit card, from your bank account, through Apple or Google Pay and even with prepaid cards. |

Fast transfers. | Cash pickups, WorldRemit Wallet transfers and airtime top-ups are typically available instantly after sending, while mobile money and bank deposits may take one or more business days to process. |

What We Don't Like

Maximum daily limits. | Transaction limits depend on how you are sending the money, while a total 24-hour cap of $9,000 applies to all transactions being sent by you out of the US. |

Changing fees. | Depending on where you are sending to, how you are paying and how you are transferring money, your transfer fees may vary. Although a base fee of $3.99 is applied to most transfers, keep an eye on this category when actually completing your transfer to make sure it doesn’t change. |

No hedging options. | WorldRemit only offers one-off transfers, unlike some of its competitors that offer additional tools to help you save money. Hedging tools are most often used to lock in an exchange rate, helping you save money on future transfers if the market shifts against your position. |

Inconsistent markups. | Exchange rates vary through WorldRemit and depend not only on the currency you are sending to but also on the destination country. Expect mid-market markups anywhere from 1-4%. |

Transfer Fees

Transfer fees for WorldRemit vary, but for sending from the US to most countries, the standard fee is $3.99. WorldRemit fees depend on the amount, the payout method and where you are sending the money. For example, the fees for cash pickup are usually higher than for a bank deposit.

Exchange Rate

WorldRemit exchange rates depend on the payout method you choose. They are locked in advance so that you know exactly how much money will reach your recipient.

Other & Hidden Fees

WorldRemit does not openly charge any other fees. However, it should be noted that WorldRemit does not disclose its exchange rate margin and that in fact, 69% of the total cost of your transfer is hidden in the margin between the actual exchange range that they use and the rate they offer you.

Additionally, if you are paying by credit card, you should be aware that your card provider might charge you a cash advance fee. It’s best to check this with your card provider directly to avoid any bad surprises. Also, if you are sending an airtime top-up, note that some countries apply taxes that will reduce the amount of airtime received by your recipient. If this is the case, WorldRemit will warn you before you complete your transfer.

Transfer Time

WorldRemit transfer speeds depend on the delivery method you choose.

Delivery method | Transfer speed |

Bank transfer | Within minutes to five business days |

Cash pickup | Instant |

Mobile money | Within minutes |

Airtime top-up | Within minutes |

| Home delivery | One to seven business days |

Ways to Send Money with WorldRemit

Depending on where you live, the ways to send money through WorldRemit may vary. WorldRemit offers the following ways to send and receive money:

1. Cash pickup.

Pick up a cash transfer at one of WorldRemit’s partner network locations – these are typically banks.

2. Bank transfer.

Have the money delivered straight to your bank account. Additional fees may apply, so always double-check with your bank before accepting a transfer this way.

3. Mobile money.

Receive money into your existing mobile wallet service, which you can then use to pay bills, withdraw at authorized agents and similar actions.

4. Airtime top-up.

Have money sent directly to your telecom network to cover your phone bill. Door-to-door delivery. Physical cash is delivered straight to your door, but you must present a valid ID that matches the details entered by the sender.

Payment Options

WorldRemit accepts different payment methods depending on where you are sending your transfer from. From the US, WorldRemit payment methods include the following:

Wire transfer from a bank account

Debit, credit and prepaid cards

Apple Pay

ACH transfer from a bank account

Around the world, WorldRemit also accepts the following payment methods:

POLi

Interac

iDEAL

Trustly

Customer Service

If you need to contact the team at World Remit, you have two options. The fastest way is to call the team directly. Not all locations have a local toll number available, so do bare this in mind.

Alternatively, you can send the support team a direct message through your online account portal. Unfortunately, there is no live chat facility.

Promotions

1. Enter promo code 3FREE for your first 3 fee free International money transfers.

2. Refer a friend to World Remit and you will both eran rewards. Once they’ve sent 100 USD or more, you’ll each be emailed a 20 USD WorldRemit voucher code.

3. Complete your transfer on Worldremit.com through Extrabux, you can get $20 Super Cash Back.

3. MoneyGram (www.moneygram.com)

MoneyGram is a Texas-based money transfer company. It is fully licensed in all the 50 states in the US and has a Foreign Transmittal License among other authorisations. The company currently serves 200+ countries and territories through its 350,000+ service locations in different parts of the globe. It is the second largest money-transfer provider. It also has a full range of funding and receiving options, including cash deliveries and phone reloads in some markets. And transfers are quick: Cash is typically available within minutes, while bank transfers take a few hours to a day or so to many popular destinations.

Pros & Cons

What We Like

Large Agent Network. | MoneyGram has more than 350,000 agents spread in 200+ countries and territories. This network enhances access to sending and receiving of money even in remote areas. |

Payout Flexibility. | When sending money, you can decide, where the transfer corridor allows, that your recipient gets the transfer as a direct deposit in their bank account, cash pickup, mobile wallet deposit or prepaid card. |

Multiple Access Points. | Sending money through the MoneyGram platform gives the sender multiple access points. You can make your transfer through the online platform, at a MoneyGram-owned store, transaction staging kiosks, or independent agents. |

Faster Transfers. | Depending on the receiving location and payout option, transfers can take minutes or hours. Transfer to mobile wallets and cash pickup locations take the shortest time. Transfers to bank accounts may take a couple of hours or a day to complete. |

Lower Transfer fees. | When sending money to bank accounts, the transfer fees are minimal or even absent. Cash pickups attract lower transfer fees with some corridors costing only 3.99 GBP for up to 6000 GBP worth of transfers. |

What We Don't Like

Lower Exchange Rates. | The exchange rate margins MoneyGram charges can go as high as 5.05%. The higher the margins the lower the rates and this means you get less money per unit of the sending currency. On average most money transfer providers charge between 0.5% to 3.5%. |

Variable Transfer Payment Methods. | Not all senders have the privilege of paying for their transfers using credit or debit cards. In countries like India, you can only send money in cash from an agent location. |

Lower Threshold. | Whereas some transfer corridors have high limits there are others such as Mexico and Kenya where you can send only up to 990 USD and 708 USD respectively. This can be limiting when sending funds to buy capital intensive assets. |

Transfer Fees

MoneyGram fees generally vary depending on the amount sent, the send and receive countries, and the payment and receive methods. Here how you can save on fees with MoneyGram:

When sending money online with MoneyGram, it’s best to pay by bank transfer if this is available.

Sending to a bank account is usually less expensive than sending money for cash pick-up.

If you send money to a bank account, it is often cheaper to send it at an agent location than online, regardless of the payment method. Still, fees at agent locations can also vary depending on which location you choose.

If you are sending money for cash pick-up, the online service will generally be cheaper than sending money at an agent location, but only if you pay by bank transfer.

Exchange Rate

Similarly to fees, the exchange rate margins MoneyGram charges really depends on the currency pair you are transferring between, as well as other variables such as the amount you are sending.

Typically, the provider charges relatively high exchange rate margins compared to other money transfer providers. If you were sending from GBP to EUR, for example, you could expect to be charged around 5.05% above the mid-market rate, while sending to AUD would have margins about 4.23% above the mid-market rate.

Transfer Time

The time it takes to send money with Moneygram will depend on:

1. Where you’re sending money to: sending money to some currencies can take longer than others. Check our comparison table above to find an estimate for most world currencies.

2. The payment method you’re using: using a debit card or a credit card to fund your transfers is usually the quickest, but can come with an extra cost.

3. When you send your money: different banks have different cut-off times, which, if you miss them, can make your money transfer take longer. Weekends and bank holidays can also have an impact on the duration of your money transfer.

Ways to Send Money with MoneyGram

MoneyGram allows senders to make four types of transfers. However, the transfers differ depending on the remittance corridor.

Direct to bank account transfers

Cash Pickup

Mobile wallet transfers -Currently, this service is available in Kenya, Tanzania, Zimbabwe, and Romania

Prepaid card reloads

Home deliveries -Cash is delivered at the recipient’s home. In Vietnam, MoneyGram has partnered with HD Bank and DongA Bank to make this possible.

Through MoneyGram, you can also top up mobile phones in 100 countries around the world. The service is simple, fast and secure. You can make the transfers from agent locations, at self-service stores, online, or through the MoneyGram mobile application.

Payment Options

MoneyGram allows you to pay for online transfers using a bank account (US only) or with a credit or debit card. You can also pay for your transfer by cash if visiting an agent location directly.

Transfer options are dependent on the country you are sending to. Where allowed, you can decide to transfer the funds to your recipient’s bank account, mobile wallet, prepaid card, or organise a cash pickup.

Customer Service

MoneyGram is here to help with all your MoneyGram services anytime you need. Whether you have a question or are reporting a problem, contact MoneyGram's Customer Service and they will respond as quickly as possible.

Report Fraud

It's easy to report fraud online, simply use the form below selecting 'Report Fraud' in the type of request drop down section and provide details of the incident.

If you suspect fraud on a transaction that has not yet been received, please contact our Customer Care Center at 001 347 6961234 in order to have the transaction cancelled immediately.

To help they investigate and resolve your issue, please provide the following information when contacting them:

Your name and address

Daytime telephone number

Time you prefer us to contact you

8-digit transaction reference number

Details of the problem and resolution being requested

Ways to contact us

Visit their frequently asked questions for answers to common questions.

Call: 001 347 6961234

Email: customerservice@moneygram.com

Promotions

1. Get Rewarded With MoneyGram Plus Rewards.

2. Complete your transfer on MoneyGram through Extrabux, you can get up to $7 Super Cash Back.

4. Western Union (www.westernunion.com)

Western Union is a money transfer and communications company based in Meridian, Colorado. Founded in 1851, Western Union originally rose to power as a widely used telegraph service before adding its money transfer feature in 1871. In the late 1980s, Western Union shifted its primary focus from communications to financial services, eventually doing away with telegram delivery entirely. In 1995, the company was acquired by First Data (now Fiserv), another large, Colorado-based financial services company. First Data spun Western Union off into its own company in 2006, and Western Union now operates as an independent entity.

Nowadys, Western Union is the largest money transfer provider worldwide with more than 500,000 locations in over 200 countries and territories. Unlike many providers, Western Union offers both domestic and international transfers; the ability to send or receive cash quickly overseas is its speciality.

Pros & Cons

What We Like

Fast transfers available. | Cash- and debit card-funded transfers can arrive within minutes to destinations in the U.S. and abroad. The recipient would pick up the cash at a physical location, such as a supermarket or bank. |

| You can send physical cash. | This isn’t an option for most nonbank money transfer providers. |

What We Don't Like

Not the cheapest. | Depending on the destination, you can find cheaper transfers both in terms of fees and rates. For example, with Western Union, sending $500 to Mexico using online funding from a bank account and delivering to a recipient’s bank account carries an $8 fee, while the same transfer scenario but to Germany has a $35 fee. To send money to developing countries, compare costs with Remitly and WorldRemit. For developed countries, look at what Wise (formerly TransferWise) and OFX offer. |

Difficult to compare costs. | Difficult to compare costs because the fee and exchange rate can vary significantly by how you pay, how your recipient receives money, and other factors. Many other providers offer a single rate, regardless of how you send or deliver money. |

Transfer Fees

Western Union equally has a fee structure that can change depending on:

The currency pair you are transferring between

The sum you are sending

Your payment method

Your payout method

Sending $200 to Singapore would have fees between $0 (for a bank transfer to a bank account), up to $12.00 (for a cash pickup paid for by credit card). Other options include a cash pickup by debit card or bank transfer, which would incur a fee of $5, or fees of $9.99 (credit card) or $2.99 (debit card) when paying for a transfer to be received in the recipient’s bank account.

Equally, sending $500 to Australia has a number of different fees depending on your payment choices. Payment by bank account to the recipient’s bank account has no fees attached (although this is the slowest method), whilst a credit or debit card payment for a bank deposit would have fees of $17.49 or $2.99 respectively. A cash pickup would have fees of $21.50 (credit card payment), $7.00 (debit card), or $5.00 (bank account).

Exchange Rate

Western Union’s exchange rate margin can also vary depending on the currency pair and whether you are making an online or agent transfer.

Typically, the provider is also known for charging relatively high margins compared to other providers. Sending money as a cash pickup can have far higher margins than a bank transfer, for example, while a larger sum can have a higher rate than smaller amounts.

Transfer Time

One great thing about Western Union is that they offer a lot of flexibility in terms of transfer speed.

You’ll be able to choose from three available options:

In Minutes

Three Day

Next Day

With the “In Minutes” plan, transfers are near instant. You can fund these with a credit card and your recipient can collect their remittance in 10 minutes.

Usually, the “Three-Day” transfer plan is the most affordable option – you can fund these with a bank transfer and your recipient can either choose to pick it up at an agent location or get it transferred into their bank account.

Ways to Send Money with Western Union

Transfer options include bank transfers, cash pickups, and mobile wallet deposits.

Payment Options

U.S. bank accounts;

Visa, Mastercard and Discover credit and debit cards;

and cash at in-person locations only.

Customer Service

Western Union is happy to answer any questions you may have.

1. Chat with them online

Get in touch with our Customer Care representative for assistance.

2. Give them a call.

Get in touch with our Customer Care representative for assistance on online money transfers.

Customer Care (US): 1800 325 6000

Website Care: 1877 989 3268

For TTY users: 1800 877 8973

3. Find a location

Find contacts of a Western Union agent location for retail-related enquiries.

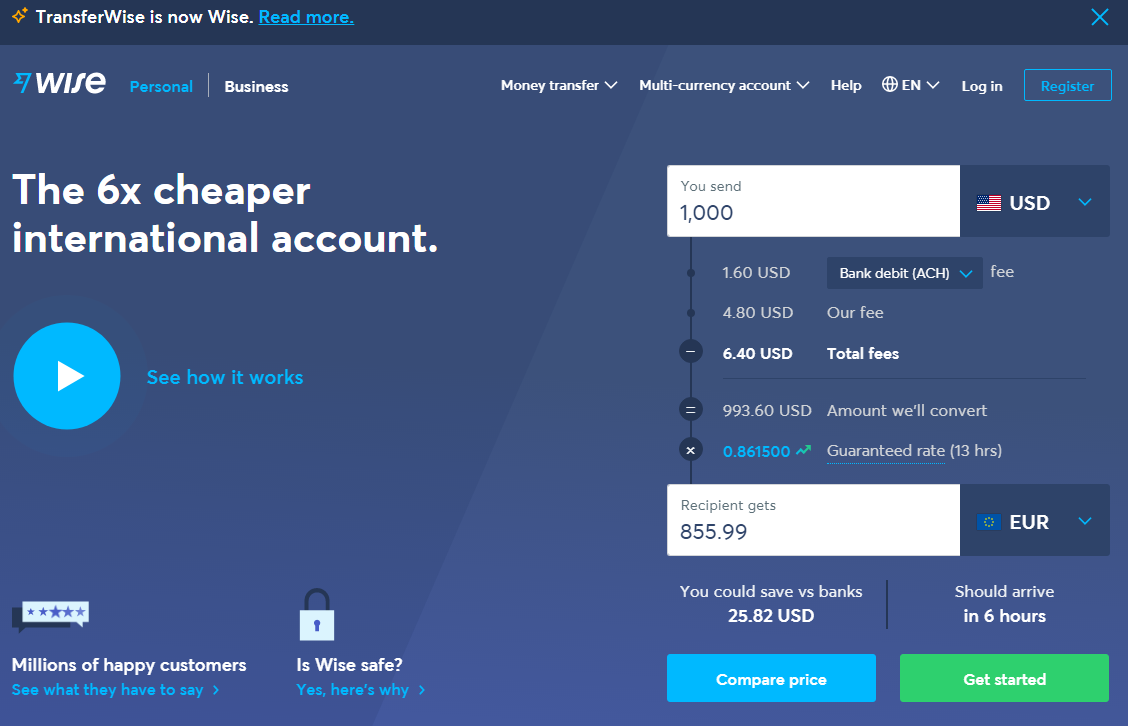

5. Wise (wise.com)

Wise, formerly TransferWise, is currently the biggest money transfer company in the UK boasting £4bn in monthly turnover. It is completely safe to use the company’s services, like millions of other Brits, Europeans, Australians and Americans do every month, but there could be better options depending on your needs.

Wise.com pride themselves on a transparent fee structure and excellent exchange rates. The online system is easy to use and users are almost unanimously satisfied.

The Wise platform has become so popular that it now serves 6 million customers across 59 individual counties. With offices now located in 12 different nations, the platform also claims that it facilitates $4 billion worth of international transfers each and every month, subsequently saving customers $1 billion per year – had they gone the traditional route.

Pros & Cons

What We Like

Delivery within minutes. | Quick delivery is possible for transfers using a debit or credit card. |

Low fees. | The fixed cost to many countries is a combination of a flat amount around $1 and a percentage slightly less than 1% of the transfer amount. Credit card fees are higher. Using an ACH transfer from your bank account or a debit card tends to be cheaper. If you pay with a wire transfer to Wise, your fee will be similar to transferring via ACH, but your bank will likely charge you (for more details, see wire transfer fees at over 40 banks). |

| No rate markups. | Unlike banks and other providers, Wise doesn’t charge an exchange-rate markup on its transfers. It targets the midmarket rate, which fluctuates minute-to-minute. |

Transparency. | All fees and costs are made crystal clear from the start, with the same flat-fees applied to most international transfers. |

Trustworthy. | As one of the top rated, long standing online global money transfer providers in the industry. |

Easy to use. | Navigating the website and mobile app is easy, with a quick sign up process for new customers, |

Great customer support. | Accessible in different languages via phone and email. |

| Diverse offerings. | Wise is branching out into other financial services including “Borderless” debit cards and multi-currency accounts, |

What We Don't Like

Slower bank transfer delivery times than other providers. | Transfers funded with bank accounts can take over a week, since each step can take days: Wise receiving, converting and delivering your money abroad. But for the four countries we analyzed (India, Mexico, Germany and the United Kingdom), the average total time is up to three business days. |

| U.S. phone support is limited to regular business hours. | You can reach customer service by phone only from 9 a.m. to 5 p.m. ET on weekdays. |

Limited countries. | A respectable 61 destination countries are covered by Wise, but this is less than other online providers like Azimo and WorldRemit. |

Occasional delays. | Wise promises a transfer speed of 1-2 business days in most cases, but some customers have reported delays of up to 4 days, depending on the destination and currency. |

No cash pick-up. | For most Wise payments, funds can only be sent via bank transfer, from the sender’s bank to the recipient’s bank. Additional payment methods are accepted for some other currencies. |

Transfer Fees

First and foremost, it is important to note that the specific fees charged by Wise will vary considerably depending on a number of key factors.

Notably, this includes the amount that you are sending, the currency you are sending, the currency the beneficiary is receiving, and how you intend on funding the transfer.

Wise is incredibly transparent about exactly what you pay, which means that you can see what you will pay very easily at each step.

Exchange Rate

Unlike other companies who add percentage-based markups onto exchange rates, Wise profit margins are not determined by the sending amount. Instead, on average, Wise exchange rate mark-ups rarely exceed 0.5%. This is very low when compared to the 3 – 7% profit margins of banks and other financial providers.

Transfer Time

The currency pair and how you pay for your transfer determine the length of time it takes for the transfer to get to your destination. Wise says that it should take between 1 and 2 days for your money to hit the recipient’s account. However, customer experiences reveal that it can take up to 4 days.

The transfer speeds for each of the above mentioned transfer types vary, due to the different processing times of each payment and delivery method:

Fast and easy transfer: recipient will receive funds instantly .

Low-cost transfer: takes up to 2 days for the money to be received and approximately 2 days for the funds to be deposited into the recipient’s account.

Advanced transfer: using the SWIFT network, this type of transfer can take between 2 – 5 business days to reflect in the recipient’s account.

Payment Options

If you are funding your Wise payment with a debit or credit card, the payment will be taken instantly. This means that the platform will execute your transfer straightaway, subsequently speeding up the transfer by some distance.

On the other hand, paying with ACH or bank wire will take much longer. Not only do you need to wait for your bank to transfer the funds, but you also need to wait for Wise to confirm receipt.

Ultimately, when it comes to payment methods, you need to weigh up whether you want to prioritize fees or speed. While a debit/credit card deposit is much faster, it is also much more expensive.

6. Xoom (www.xoom.com)

Xoom, owned by PayPal, is in the business of speed. Established in 2001, the web-based provider makes most transfers within minutes. You can send money from the U.S. to more than 160 countries with different delivery options, such as deposits into bank accounts and cash for pickup at locations, depending on the country. But you’ll need to provide a lot of personal information in order to send larger amounts of money.

To use Xoom, you'll need to first register for an account and download the mobile app. Then you'll be able to send money through the app or by logging into the Xoom website. Your money transfers can be funded by a bank account, debit card, credit card, or PayPal balance.

After making a transfer, you'll be sent an email or text status alerts. You can also track the progress of your transfer within the app.

Xoom does charge fees for all transfers. These fees typically start at $4.99 and go up from there. You can also use Xoom to pay a bill -- and the fee is $2.99.

Pros & Cons

What We Like

Affordable if you fund with a bank account. | Xoom charges a fee of $4.99 or less for transfers using bank accounts to many destinations, regardless of how much you send. |

Xoom is fast. | Money can arrive within minutes in most cases, even transfers funded with bank accounts, which can take as long as a week with some competitors. |

High transfer limits for verified accounts. | Send up to $100,000 per day to a recipient’s bank account by verifying personal information through Xoom. |

Low transfer minimum. | You need to transfer at least $10 to move money with Xoom. |

Easy-to-use website. | Xoom organizes its website by destination country, so you can see what costs, speeds and delivery options are available for your transfer without logging in. For the frequent customer, there’s a feature to quickly send a transfer you’ve done before. FAQs are well-organized and clear. |

Multilingual customer support. | Agents can speak English, Spanish, French or Filipino if you need help by phone in the U.S. or Canada. You can get help via email in Vietnamese and Chinese, too. |

| High-rated apps. | The mobile app receives 4.7 stars on the Google Play store and 4.8 stars for iOS. |

What We Don't Like

Some destinations take longer. | Its website says some deliveries take up to a few days — though this is the minimum for bank deposits at many competitors. |

Must verify personal information to transfer higher amounts. | You can transfer only $2,999 per day if you have only a basic profile on the site. |

Lacks some support channels. | There’s no live chat support, which some other providers do offer. |

Card funding carries high fees. | You'll pay almost $90 to send $2,999 — the daily maximum for a user who has only filled out a basic profile and hasn't verified additional information with Xoom — to some popular countries with a credit or debit card. And your credit card issuer can also tack on additional costs, such as interest and cash advance fees. |

Transfer Fees

Xoom's transfer fees vary depending on where you're sending your money from and to, as well as the transfer method involved. In general, fixed fees are not applicable to larger bank transfers (usually above US$1,000) and only affect smaller bank transfers. For example, a US$750 transfer from the US to a bank account in India would incur a US$4.99 fixed fee.

In addition to the fixed fee, Xoom also charges a variable commission (usually between 2.9% and 3.3% of the transaction value) for debit and credit card payments.

Exchange Rate

The second transfer cost comes in when you're charged the difference between the "real" exchange rate (known as the mid-market exchange rate) and the rate which Xoom decides on. This difference is known as the exchange rate margin, and is expressed as a percentage.

Xoom's exchange rates hover between 0.4% and 1.5% in general for most currencies, which make them reasonably priced compared to many other players on the market and on par with Western Union. Xoom is, on average, more expensive than many other services due to the fact that it charges the above fixed fees and commissions in addition.

Bear in mind that Xoom exchange rates decrease in proportion to the size of the transfer. For example, if you were to send a small transfer of US$500 to India, your exchange rate margin would be around 1.1%. Meanwhile, if you were to send a larger transfer of US$10,000, your exchange rate margin would be only around 0.4% instead.

Fees vary according to the country combination, how you pay for your transfer and the money delivery option you choose. For example, transaction fees are generally anywhere between zero and US $5. Exchange rates are above the mid-market exchange rate.

Transfer Time

Xoom’s transfer speed depends on the funding method, the payout method, the recipient country as well as the transfer amount.

Typically, transfers funded with credit or debit cards are usually received within minutes.

However transfers funded by bank accounts (and sent to bank accounts) usually take 3-5 days which is normal and most of this time is taken up by the banks at either end.

The great thing about Xoom is they keep you updated with regular text messages and email notifications about the status of your transfer.

Ways to Send Money with Xoom

Bank deposit at the recipient's bank, cash pickup at a location such as a bank or retail store in many countries and delivery straight to a recipient’s home in a few countries.

Payment Options

Bank account, debit card or credit card — standard for many online providers. You can also pay using your PayPal balance.

Customer Service

Click here to see the details.

Transfer Limits

Xoom has sending levels, rated from 1 to 3 depending on how much required documentation you've provided as verification. You can move up in levels by providing more documentation -- for example, your Social Security number or passport details, copies of bank statements, or driver's license.

If you're unsure what level you're at, you can check within the Xoom app.

Here are the sending limits for users sending funds from the United States:

Bank deposit maximums

| LEVEL | 24-HOUR LIMIT | 30-DAY LIMIT | 180-DAY LIMIT |

1 | $2,999 USD | $6,000 USD | $9,999 USD |

2 | $10,000 USD | $20,000 USD | $30,000 USD |

| 3 | $50,000 USD | $60,000 USD | $100,000 USD |

LEVEL | 24-HOUR LIMIT | 30-DAY LIMIT | 180-DAY LIMIT |

1 | $2,999 USD | $6,000 US | $9,999 USD |

2 | $10,000 USD | $20,000 USD | $30,000 USD |

| 3 | $10,000 USD | $20,000 USD | $50,000 USD |

7. Venmo (venmo.com)

Venmo is the payment app of choice for sending money to friends and family. It's widely used, you can send money by whichever payment method you want, and recipients get funds instantly.

One of the best reasons to use Venmo is that there's a good chance anyone you want to pay—or get money from—is also using it. Though the same could be said of the app from its parent company, PayPal, Venmo remains the highest-profile peer-to-peer mobile payment app around. It smoothes the flow of money between friends, turning it into a social entertainment. There are some downsides to this visibility, but the app also offers real benefits. Splitting payments, requesting money, and moving funds into your bank account are all part of Venmo's strong execution.

Pros & Cons

What We Like

Quick, convenient payments

Free to send money from a bank account or debit card

Low fee for credit card payments

Can pay for purchases at select businesses

Offers a debit card and a credit card

Adds a social element to sending and receiving money

What We Don't Like

Payments are public by default

Can't cancel payments

No international transactions

Popular with scammers

Transfer Fees

Venmo is secure and is free to send money using a balance within the Venmo app, linked bank account, debit card or prepaid card. You’ll pay a 3% fee when you use a credit card to send money.

Transferring money from Venmo to your linked bank account is free with a standard transfer. This could take some time, usually 1-3 business days.

If you’re short on time, you can initiate an instant transfer, which carries a 1% fee or a minimum of $.25 and a maximum of $10. These fees increase Aug. 2, 2024 to 1.5% to transfer instantly with the same minimum but an increased maximum fee of $15.

Venmo users can also buy or sell cryptocurrencies with fees attached.

Exchange Rate

International payments aren't an option with Venmo. To open a Venmo account, you must live in the United States and have a U.S. cell phone number. You can also only transfer your Venmo balance to a U.S. bank account. If you want to send money to friends or family outside the country, you need a different payment app.

Transfer Limits

Under $5,000 per week. To get started on Venmo, you need to download the mobile app, create a login and confirm your phone number, email address and bank account information. Your initial transfer maximum per week is $299.99 until you verify more of your identity. When you submit your Social Security number, ZIP code and birthdate, you become “verified” and can send up to $4,999.99 per week in one or multiple transactions. (Venmo increased this limit, previously $2,999.999, in 2020 during the COVID-19 crisis.)

The maximum you can transfer from Venmo to a bank account starts at $999.99 per transaction, but once you’re verified, the limit goes up to $19,999 per week.

Payment Options

Bank account

Debit card

Venmo balance

Credit card

Customer Service

Click here to see the details.

Promotions

1. Get $10 when you sign up for Venmo (Offer ends 12/31/2024).

Extrabux is an international cashback shopping site, offering up to 30% cashback from 10,000+ Stores!

Squarespace, SkinStore, MATCHESFASHION, The Wall Street Journal, NordVPN, Visible, Armani Exchange, Sam's Club, PUMA, AliExpress, Card Cash, NET-A-PORTER, Udacity, Udemy, Selfridges, LOOKFANTASTIC, Vimeo, Coach Outlet, lululemon, PrettyLittleThing, Booking.com, Ripley's Aquarium, iHerb, Groupon, etc.

Join to get $20 welcome bonus now! (How does Welcome Bonus work?)

Recommendation

-

10 Best & Stylish Winter Coats for Women on NET-A-PORTER in 2024

-

Top & Best 12 Sneaker Apps/Websites for Raffles, Releases & Restocks in 2024

-

7 Best Gift Card Exchange Sites - Buy, Sell and Trade Discount Gift Card Safely and Instanly!

-

Top 9 Professional Skincare Brands for Licensed Estheticians 2024

-

13 Best Luxury Online Shopping Sites with Highest Cashback in 2024 (Coupon Code+Sale+14% Cashback)

Up to 14% Cashback!